How to Find a Financial Advisor

Financial advisors are professionals who have years of experience and professional knowledge to identify market opportunities and help you save and invest for your financial future. If you’re currently looking to manage and grow your finances and are unsure of how to start, reach out to a financial advisor who can help you with suitable investment strategies for your unique financial needs and goals.

A common misconception when it comes to hiring financial advisors is that it would be an expensive proposition that can only be afforded by high-net-worth individuals. That is not the case; a financial advisor can add value to investors belonging to all income groups irrespective of your present income, and current assets. If you wish to know more on how and where to find a financial advisor, then this article is for you.

Table of Contents

- How and Where To Find A Financial Advisor

- Step 1: Determine the type of financial advisor you need based on your financial goals

- Step 2: Once you have determined the type of financial advisor you need, start your search for an advisor that meets your financial requirements.

- Step 3: Check and verify the credentials of the financial advisor you wish to hire

- Step 4: Create a list of questions to ask the financial advisor

- To conclude

Need a financial advisor? Compare vetted advisors matched to your specific requirements.

Choosing the right financial advisor is daunting, especially when there are thousands of financial advisors near you. We make it easy by matching you to vetted advisors that meet your unique needs. Matched advisors are all registered with FINRA/SEC.

Click to compare vetted advisors now.How and Where To Find A Financial Advisor

Read below for more information on how you can find the most suitable financial advisor for your unique financial requirements:

Step 1: Determine the type of financial advisor you need based on your financial goals

Broadly speaking, financial advisors can be categorized as:

1. Investment advisors:

An investment advisor offers investment advice to you and helps you pick the most profitable investment options for you and your goals. Additionally, your investment advisor may also manage your investments on your behalf and take calls related to the entry and exit of your investments to safeguard your investment portfolio. If you’re looking for specialized advice on securities and investments, you can go for an investment advisor.

2. Financial planners:

A financial planner is a professional who assists you with holistic financial planning, offering you exhaustive advice and services related to retirement planning, education planning, budgeting, investment planning, debt settlement, tax planning, etc. A financial planner might be suitable for you if you are looking for holistic financial planning.

3. Wealth managers:

As the name suggests, wealth managers manage accounts of wealthy investors and exclusively work with high net worth and ultra-high net worth individuals only. Typically, wealth managers offer services such as investment planning, business succession planning, tax planning, estate planning, asset acquisition, and more. If you are a high-net-worth investor, then a wealth manager would be ideal for you, as they have experience in managing high volumes of wealth.

4. Retirement planners:

A retirement planner can help you with more than just ensuring you save enough for retirement; they can also assist you with other areas of financial planning such as creating an effective withdrawal strategy for your retirement years, making penalty-free withdrawals from your retirement saving accounts, planning for rising healthcare and long-term care expenses, as well as tax management and estate planning if needed. Consider hiring a retirement planner if you are nearing retirement and wish to plan efficiently for a comfortable retirement lifestyle in the coming years.

5. Robo-advisors:

Robo-advisors are digital advisors who use computer algorithms to recommend investments based on the information given by you. These virtual advisors assess the information given by you to evaluate your risk tolerance and recommend investments and savings instruments that match your financial goals and investment concerns. Further, even though robo-advisors are a convenient way to receive expert financial advice, they lack the human touch. Robo advisors are best suited for individuals who have a low amount of capital to invest and are looking for cheaper alternatives to start investing.

Step 2: Once you have determined the type of financial advisor you need, start your search for an advisor that meets your financial requirements.

There are several options available to you to look for a financial advisor. Since every individual has a unique set of financial needs and goals, they may require an advisor who holds financial expertise in that particular domain. For instance, someone looking to invest in securities would need the services of an investment advisor while a person thinking to retire and build a retirement corpus would need to hire a retirement planner. If you do not know where to begin looking for a financial advisor, you can try the following options listed below:

1. Search engines:

It may seem obvious at first, but you cannot overlook the power of a search engine. A quick Google search for “financial advisor near me”, “best financial advisors” or “financial advisor in <your city name>” etc. can provide you with a list of suitable financial advisors that you may consider reaching out to for your financial needs. You can use popular search engines like Google, Bing, or Yahoo to search for financial advisors who practice in your city or state. Note that ads usually appear first on google search results, followed by organic search results below. It is good practice to consider all options before making your final decision.

2. Recommendations from family, friends or colleagues:

You can also reach out to your circle of friends and family to suggest someone who they have worked with before. It is easier to trust someone who has been vouched for by someone you know. However, note that there may also be a disadvantage if you go down this route. Each individual has unique financial needs and finances. Hence, a financial advisor who is the right fit for your friend or aunt may not be best suited to meet your needs.

3. Using an online ‘find a financial advisor’ match service:

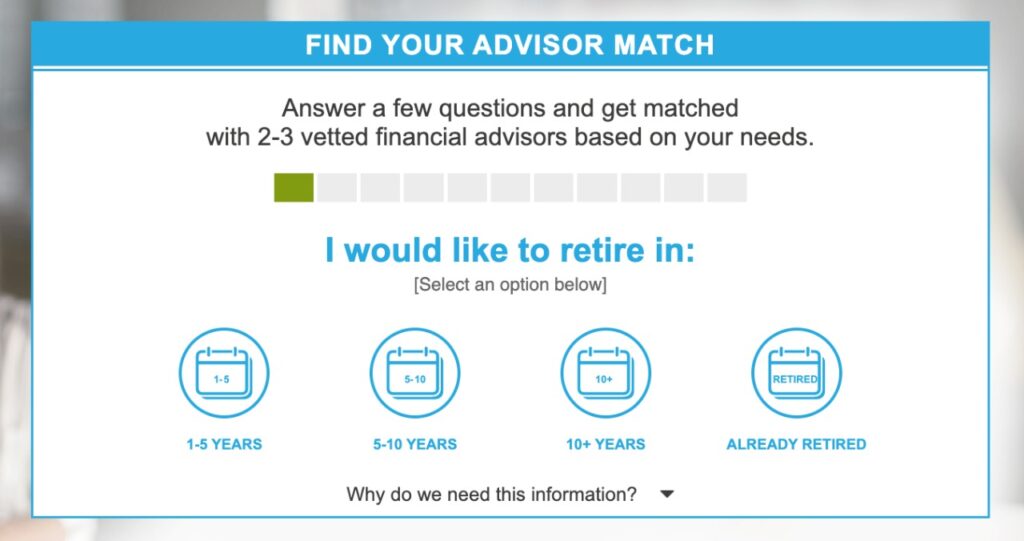

Financial advisor match services are usually free services that match you to suited pre-screened advisors based on basic information you fill in on yourself and the financial service you’re looking for. WiserAdvisor is one such company that offers this service. We have been connecting consumers to vetted financial advisors nationwide since 1998. You may browse WiserAdvisor’s online database of financial advisors to find an advisor near you, or use their free advisor match tool.

What does WiserAdvisor do?

WiserAdvisor is an independent financial advisor matching service with a database of registered financial advisors. Using WiserAdvisor, you can find highly qualified and vetted fiduciary advisors who are legally bound to place your interests above their own. You may use WiserAdvisor’s free match service to get matched with 1-3 advisors that are suited to meet your financial requirements.

Why use WiserAdvisor?

WiserAdvisor operates independently of the advisory firms and helps you find pre-screened advisors. You can review matched profiles and are under no obligation to hire. WiserAdvisor offers a free service and does not charge a match fee for finding you a suitable financial advisor.

Services offered by WiserAdvisor

Below are the main services you can avail by using WiserAdvisor:

- Free match service to connect with vetted financial advisors: Consumers looking for a financial advisor can answer a few simple questions about themselves using WiserAdvisor’s free advisor match service and get matched with 1-3 vetted financial advisors that are suited to meet their financial requirements and goals. Rest assured that the matching tool is fully secure and private, and there is no obligation on your part to hire one of the advisors that you may be matched to. You may also choose to interview the advisors matched to you before you decide to hire one. It is also recommended that you consider all your options by interviewing all the advisors you are matched with, before making your decision to hire one.

- Directory listing of qualified financial advisors in the USA: WiserAdvisor’s database consists of advisors belonging to large fortune 500 companies as well as small independent financial firms. Each financial firm or independent advisor must pass a stringent qualification process before they can become a part of WiserAdvisor’s financial advisor directory. All listed financial advisors are registered with FINRA/SEC and hold credentials such as Certified Financial Planner (CFA), Certified Public Accountant (CPA), and more. If you wish to research and reach out to an advisor directly, you may browse the advisor directory organized by cities and states to choose an advisor as per your location and preferences. You may also check their contact details, credentials, fee structure, biographies, and firm details on their profile.

The WiserAdvisor website also provides some helpful investor tools such as calculators and blogs to help investors learn more about their finances. You can use financial calculators to assess your financial preparedness and make financial decisions. In addition, you can browse the WiserAdvisor blog to improve your financial knowledge and learn tips and tricks to improve your financial knowledge. These tools can help you figure out how prepared you are and what you can do to improve your financial situation.

How does WiserAdvisor work?

As stated earlier, WiserAdvisor free match service connects you to 2-3 vetted and qualified financial advisors that are matched to you based on your unique financial needs and goals. All you need to do is fill in basic information about yourself, based on which the service can match you to a suitable advisor. You may also use the WiserAdvisor Financial Advisors Directory to find a suitable financial advisor for your needs, based on your location. Enter your zip code using the advisor list search to access a list of qualified financial advisors in your area. Upon reviewing the advisor’s background and credentials, you may choose to inquire with the advisor for further information.

Below are a few simple steps one can take on WiserAdvisor to find an advisor match for their needs:

Enter your zip code on wiseradvisor.com to access our multi-step form.

Next, answer a few questions about yourself based on your current financial situation and financial goals.

Once you have filled out the form, you’ll hear from WiserAdvisor on a suitable advisor match for your financial needs, after which you may interview each prospect and choose one that best interests you.

Step 3: Check and verify the credentials of the financial advisor you wish to hire

To understand more on an advisor’s field of expertise in the financial services they offer, it is good practice to review the advisor’s designations. An advisor’s designation indicates their degree of knowledge and training, and there are over 100 different types of advisor certifications and designations for them to choose from. Below are some of the well-known designations you may look out for:

1. CFA (Chartered Financial Analyst):

A chartered financial analyst, or a CFA, is a designation awarded by the CFA Institute and is recognized worldwide. Candidates who pass three levels of exams which cover subjects like accounting, economics, money management, ethics, and security analysis qualify to receive this designation. A CFA focuses on designing a portfolio with suitable investments.

2. CFP (Certified Financial Planner):

A CFP is a recognition of expertise in the areas of financial planning such as investing, taxes, insurance, estate planning, and retirement. The certification is issued by the Certified Financial Planner Board of Standards, Inc.

3. ChFC (Chartered Financial Consultant):

While a ChFC might be a lesser well known designation than a CFP, it actually involves additional training in financial planning than a CFP in order to hold the designation. Specifically, while a ChFC requires the same core curriculum as a CFP, it involves further education on improving one’s skills in wealth management and other areas of financial planning. Candidates are required to pass 8 courses and are also required to complete full-time work in a related field for at least three years. A ChFC provides financial advice and services pertaining to tax planning, retirement planning, investment and estate planning, etc. Hence, choosing a ChFC might be a good idea if you’re looking for someone with knowledge and experience in the financial planning space.

Step 4: Create a list of questions to ask the financial advisor

Finding an advisor can be challenging, especially one that you can trust. Having a list of questions that you can ask potential advisors at the time of hiring can help you make a decision and choose one that best matches your needs and goals. Questions such as whether they are a fiduciary, how they get paid, and what their investment philosophy is are good places to start. Click here for a detailed list of questions to ask advisors when interviewing them.

To conclude

The assistance of a financial advisor in growing and managing your finances is highly recommended as they can help you effectively and strategically plan for a secure and comfortable financial future. However, it is important to be cautious and research well when conducting your financial advisor search, so you may find an advisor that is qualified and experienced while also being well suited to meet your unique financial requirements. If you are just starting out on your investment journey and are thinking about how to find a financial advisor you can trust, use WiserAdvisor’s free advisor match service to find highly qualified and vetted fiduciary advisors. Answer a few questions about yourself and get matched with 1-3 fiduciary advisors that are suited to meet your financial requirements.

A team of dedicated writers, editors and finance specialists sharing their insights, expertise and industry knowledge to help individuals live their best financial life and reach their personal financial goals. We believe that there is no place for fear in anyone's financial future and that each individual should have easy access to credible financial advice.

Related Article

8 min read

14 Aug 2025

The benefits of working with a Financial Advisor

The role of a financial advisor is clear. A financial advisor is someone who helps you manage your money, including how to grow and protect it. They offer services such as tax planning, retirement strategies, estate planning, budgeting, saving, investing, and debt management. However, you have probably encountered this textbook definition a dozen times. So, […]

10 min read

10 Jul 2025

Financial Advisor vs Self-Investing: Why Self-Investing May Not Always Be a Good Idea

If you are someone who loves a good Do It Yourself (DIY) challenge, whether it is fixing your own car or kitchen sink, you might think investing is just another task you can master on your own. And honestly, you are not entirely wrong. Self-investing, or DIY investing, is incredibly popular. Many people have managed […]

8 min read

02 Jul 2025

The Role of Financial Advisors in Managing Healthcare Expenses

Healthcare costs are rising at a pace that demands attention, particularly for individuals nearing retirement. In 2023, the United States’ National Health Expenditure (NHE) reached $4.9 trillion, equating to $14,570 per person, a 7.5% increase from the previous year. This upward trend is expected to continue, with PwC projecting an 8% annual rise in medical […]

10 min read

17 Apr 2025

6 Reasons Why a Financial Advisor May be Right for You

Financial planning and advice from a professional go hand in hand. If you have ever felt stuck while trying to make sound financial decisions, hiring an advisor can be helpful. Financial planning can be cumbersome and take a lot of your time. However, a financial advisor can help you overcome financial challenges and offer professional […]

More From Author

14 min read

23 Jan 2024

How to Determine If Your Financial Advisor Is Doing a Good Job Each Year

The decision to hire a financial advisor is a prudent move. Seeking professional advice can provide valuable insights and a roadmap to achieve your financial goals with strategic planning. But the world of financial advice is crowded. While some advisors bring qualifications, expertise, and a commitment to your financial well-being, others may fall short of […]

4 min read

30 Oct 2023

How to prepare for a meeting with your Financial Advisor

What do you do before you visit a doctor? Understand your condition, prepare for all the questions that the doctor would ask, ensure all your test reports and medical history documents are in order and so on. Preparation is a must even before you visit a financial advisor. Table of Contents7 Things to do to […]

3 min read

26 Jul 2019

Best Retirement Calculators to plan Retirement

It is said that a goal without a plan is just a wish. This holds true even for retirement planning. You dream of a peaceful retired life. To achieve that you must plan for your golden years well in time. Various retirement tools make your task easier. For example, a retirement calculator helps you calculate […]

4 min read

23 Mar 2020

How to get rid of Money Anxiety?

Is money anxiety even a thing? Yes, it is! Money anxiety is something we all have dealt with or are likely to deal with at some point in our life. Sometimes, you may not even know that you are money anxious unless you take note of it. But the good part here is that money […]

Find & Compare Top Financial

Advisors in your area

Get Started

Popular Posts

Categories

- Business Finance (2)

- Education Planning (31)

- Estate Planning (31)

- Financial Advisor (1)

- Financial Advisor Guide (55)

- Financial Planning (138)

- Investment Management (99)

- Personal Finance (15)

- Portfolio Management (1)

- Retirement (30)

- Retirement Healthcare (1)

- Retirement Planning (109)

- Retirement Plans (1)

- Uncategorized (4)

Subscribe to our

newsletter & get helpful

financial tips.

The blog articles on this website are provided for general educational and informational purposes only, and no content included is intended to be used as financial or legal advice. A professional financial advisor should be consulted prior to making any investment decisions. Each person’s financial situation is unique, and your advisor would be able to provide you with the financial information and advice related to your financial situation.